Trusted by Europe’s Top Developers

Financial Management for Development and Retrofits

Managing budgets, costs, and financing across projects is complex.

.png)

.png)

.png)

.png)

OVERVIEW

What is Financial Management in Real Estate Development?

Financial management in real estate development isn't complicated in theory.Whether you're developing new projects or managing a lot of CapEx for retrofit projects, it goes like this:

You budget. You track costs. You manage financing and you report. Every euro gets planned, monitored, and accounted for — from feasibility assessment to handover to an asset manager.

The complexity comes from execution. Most developers still run projects on fragmented spreadsheets. Manual updates. Version control chaos. Different stakeholders working off different numbers. By the time you reconcile everything, the data's already outdated.

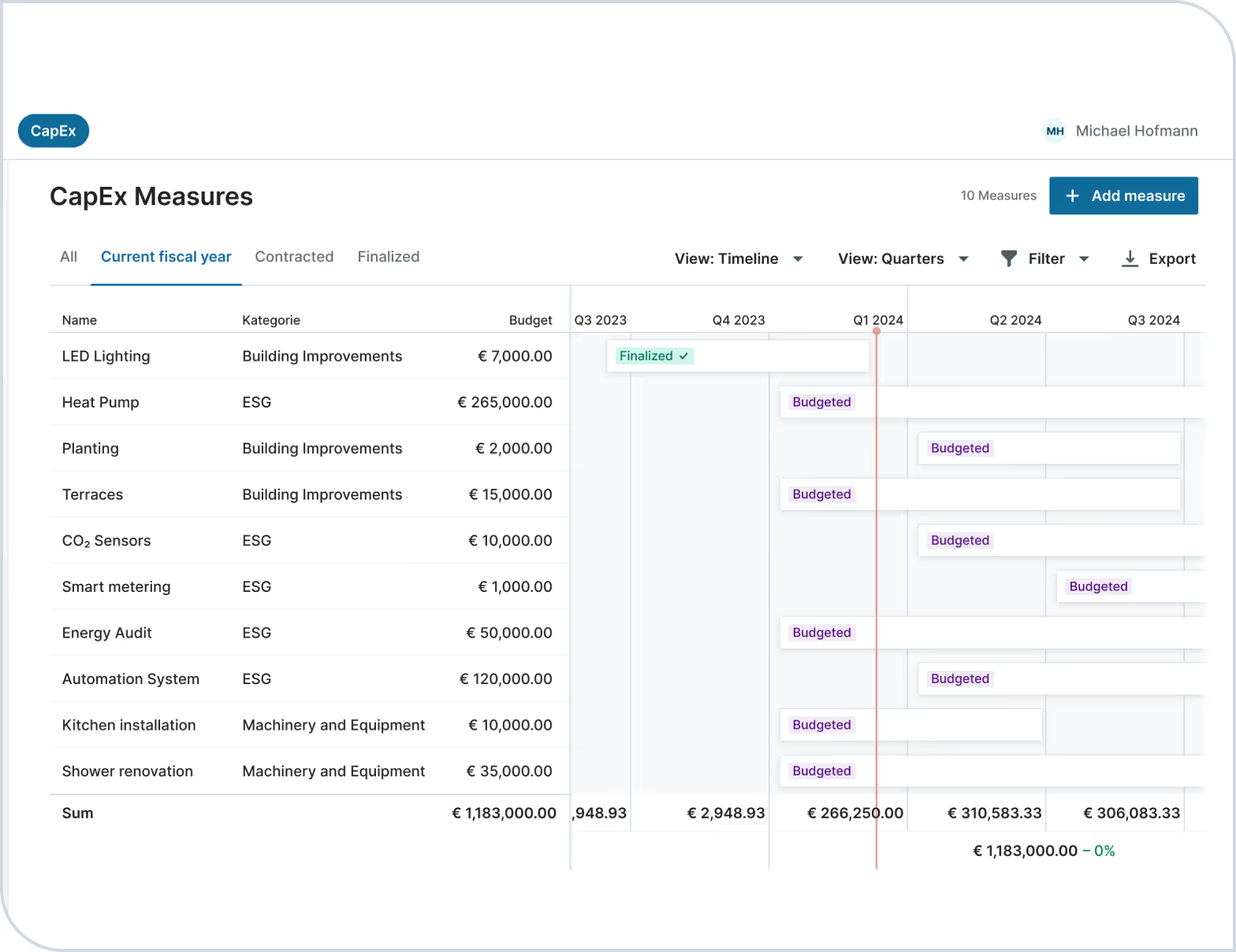

Take CapEx planning as an example - property managers, ESG managers, and facilities managers all make suggestions. Asset managers have to collate and bundle them, then run them up the chain to the investment managers, then secure the funds, allocate the funds, track execution, and report. All this is manual, all this is via Excel and email. Cost controlling is also manual.

A strong financial management system does one thing: creates a single source of truth. Budget vs. actuals. Cash flow forecasts. Financing tranches. Investor reporting. Everyone sees the same numbers in real time.

Projects are growing in scale and complexity, while skills are scarce. Construction costs are rising. Financing is tighter. Investors and banks demand greater transparency. Without robust financial management, you're flying blind. With it, you protect margins, meet investor expectations with confidence, and secure financing faster.

CHALLENGES

Why Developers Struggle with Budgets, Costs, and CapEx Planning and Oversight

Cash flow forecasting: manual, unreliable, slow

Rebuilding Excel models by hand, adjusting for cost changes, and tracking tranches manually makes forecasting slow and error-prone — with no real-time view of your liquidity.

Financial reporting: always outdated

You consolidate spreadsheets from multiple teams and versions. By the time reports are ready, the numbers are outdated — making every investor update a potential trust issue.

Scaling projects, not processes

Your pipeline grows, but your tools don’t. Managing dozens of projects manually causes delays, errors, or staffing overload — and Excel can’t keep up with complex financing needs.

Budget vs. actuals: too late to react

Actuals arrive after the fact — too late to course correct. Overruns go unnoticed until damage is done, and spreadsheets make early intervention nearly impossible.

BEST PRACTICES

Proven Ways to Improve Cost Control and Financial Oversight

Here’s what the most advanced investment managers, developers, and controllers are doing to move to proactive financial management:

Create a financial data hub

Financial data lives everywhere. Excel. ERP systems. Email threads. Every decision slows down. Every number needs verification. A centralized platform with role-based access means everyone works from the same real-time data, the same real-time financial reporting — with a full audit trail. No more version control chaos. And of course, this paves the way for deploying AI models on top of your data.

Move to rolling, scenario-based forecasts

Static cash flow plans are outdated before you finish building them. Rolling forecasts tied to project stages, vendors, and financing tranches lets you test scenarios, protect liquidity, and make drawdown decisions with confidence instead of guesswork. Because good cost forecasting means good margins.

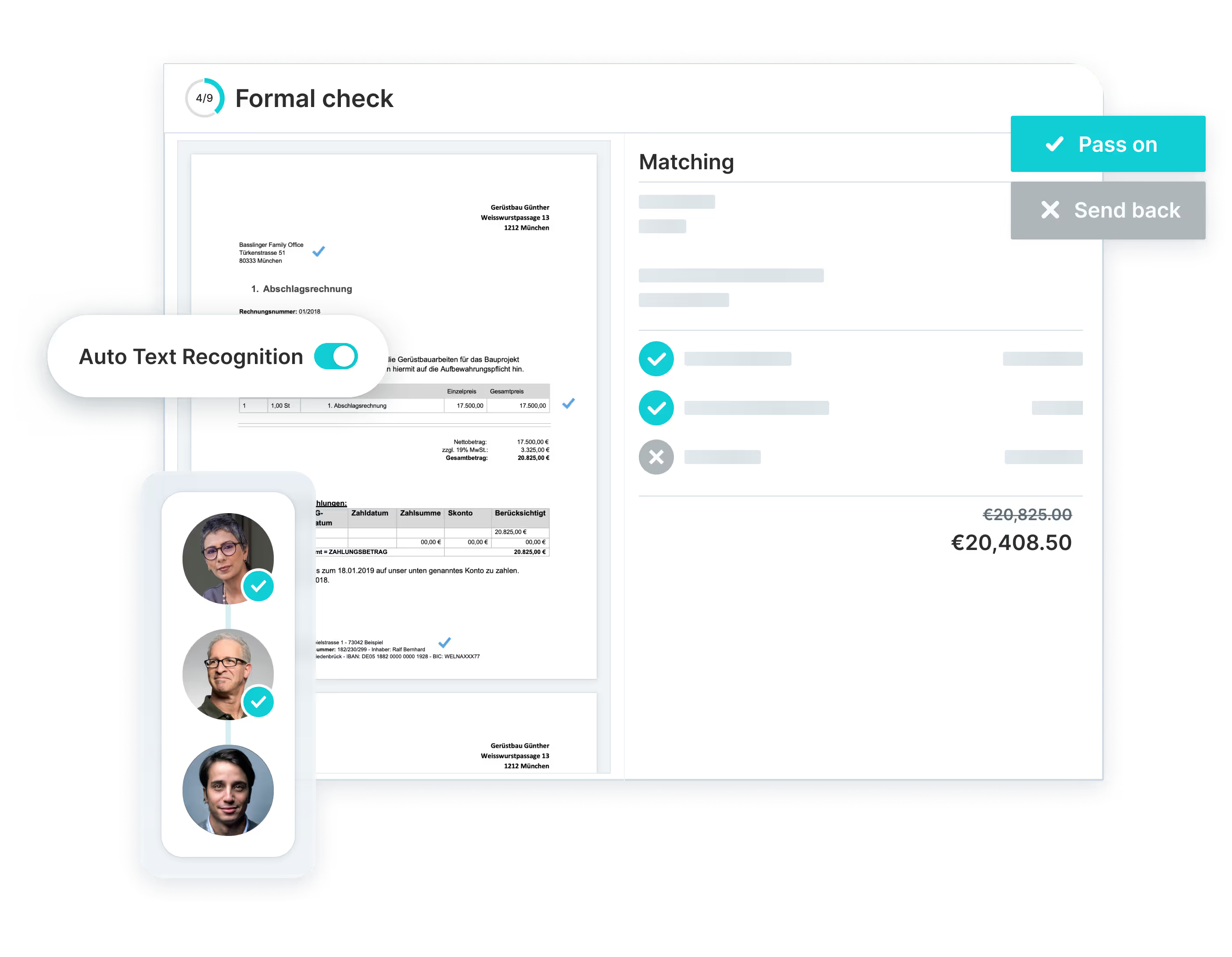

Automate invoice processing and approvals

Financial data lives everywhere. Excel. ERP systems. Email threads. Every decision slows down. Every number needs verification. A centralized platform with role-based access means everyone works from the same real-time data, the same real-time financial reporting — with a full audit trail. No more version control chaos. And of course, this paves the way for deploying AI models on top of your data.

Standardise cost structures and reporting

Leading developers use consistent cost codes across all projects. No ad-hoc spreadsheets. Clean budget vs. actual comparisons. Portfolio-wide roll-ups that investors and lenders actually trust. Standardisation turns chaos into clarity.

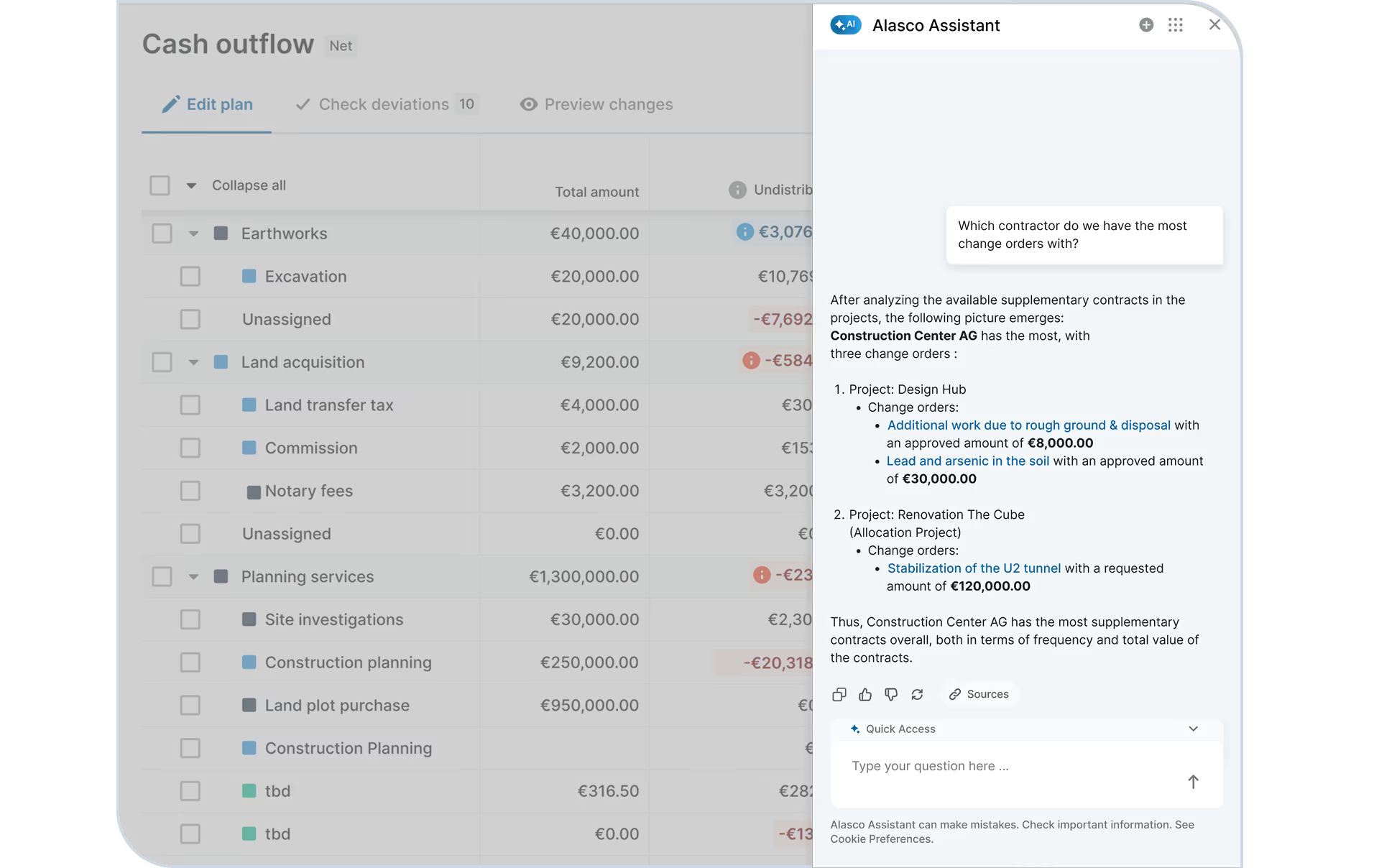

Deploy AI for proactive risk mitigation

Advanced teams don't compare budgets after the fact. They connect schedule and cost data to spot risks early. AI monitors invoices continuously, flags anomalies, and explains variances by linking them to market movements or project events. It forecasts costs based on real-time spend and raises alerts before budget overruns happen. Reporting shifts from backward-looking to proactive early warning systems.

Report in investor-ready standards

Banks and investors expect clear, auditable reporting. Forward-thinking developers structure reports to meet these standards by default. The result: faster financing rounds, easier approvals, and long-term trust that unlocks more capital when you need it.

SOFTWARE

How Software Like Alasco Simplifies Budgeting, Approvals, and Reporting

When best practices are hard to scale manually, that’s where software steps in.

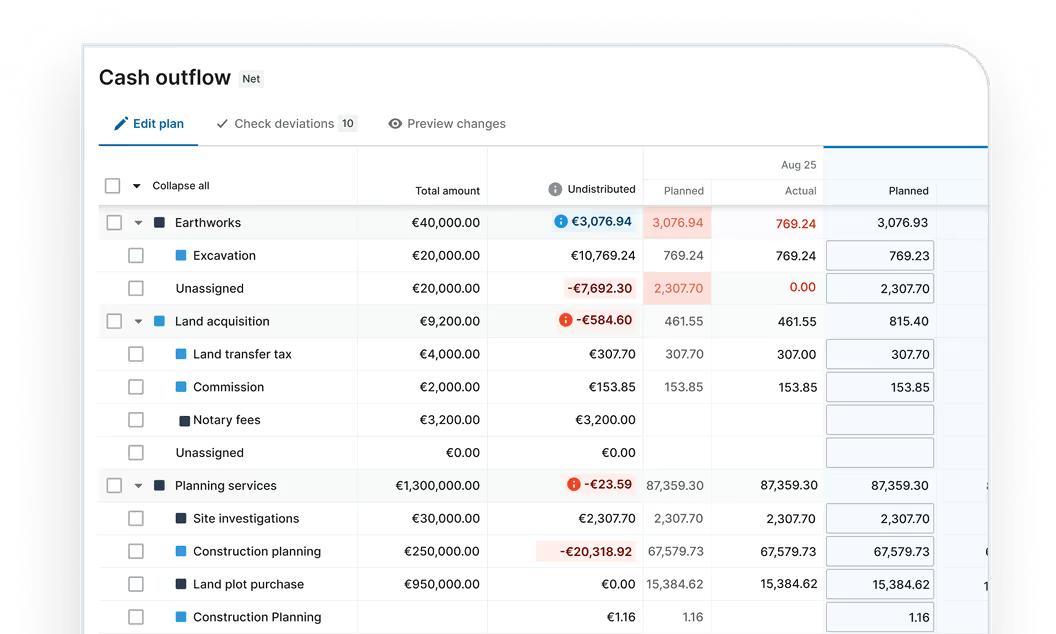

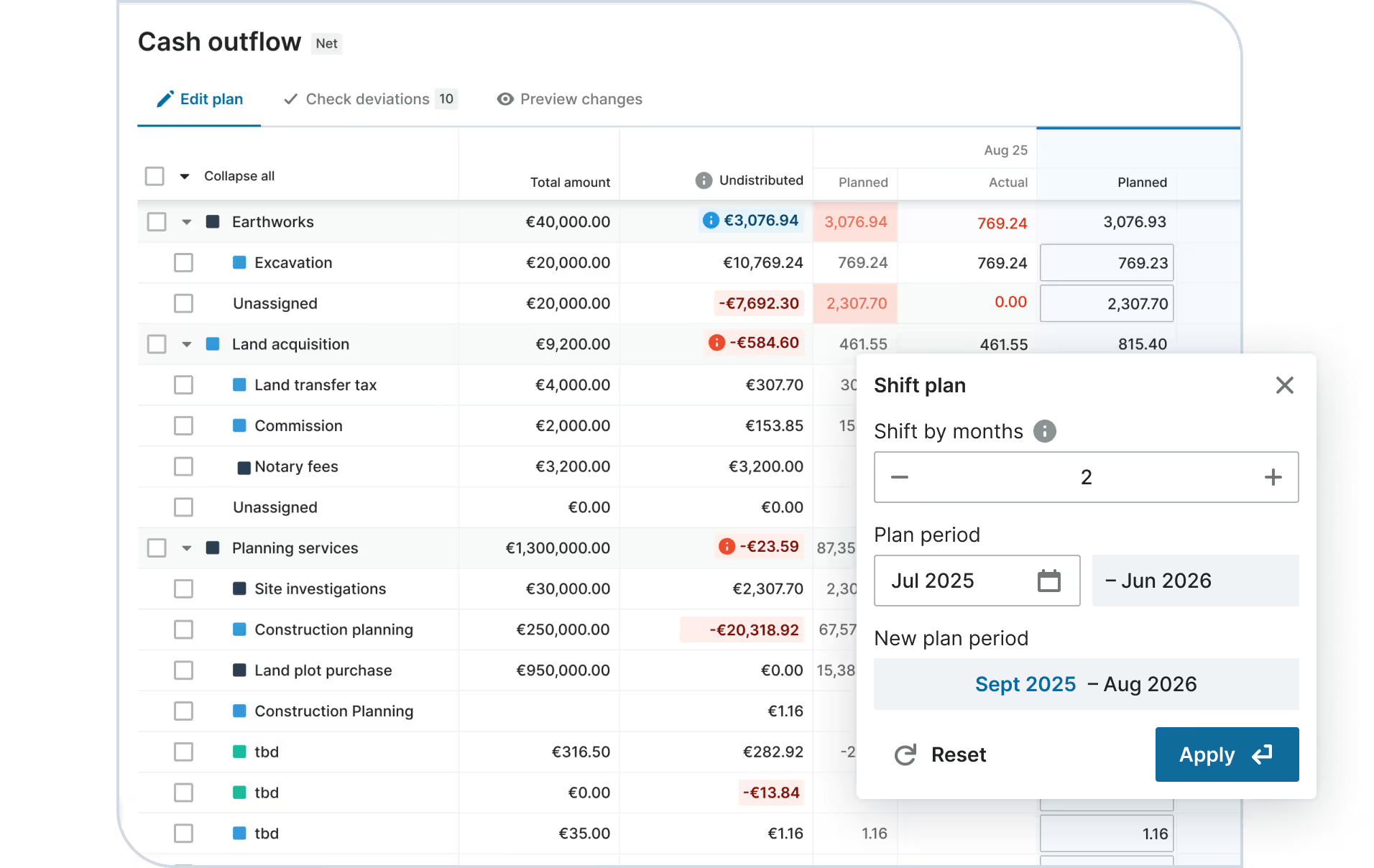

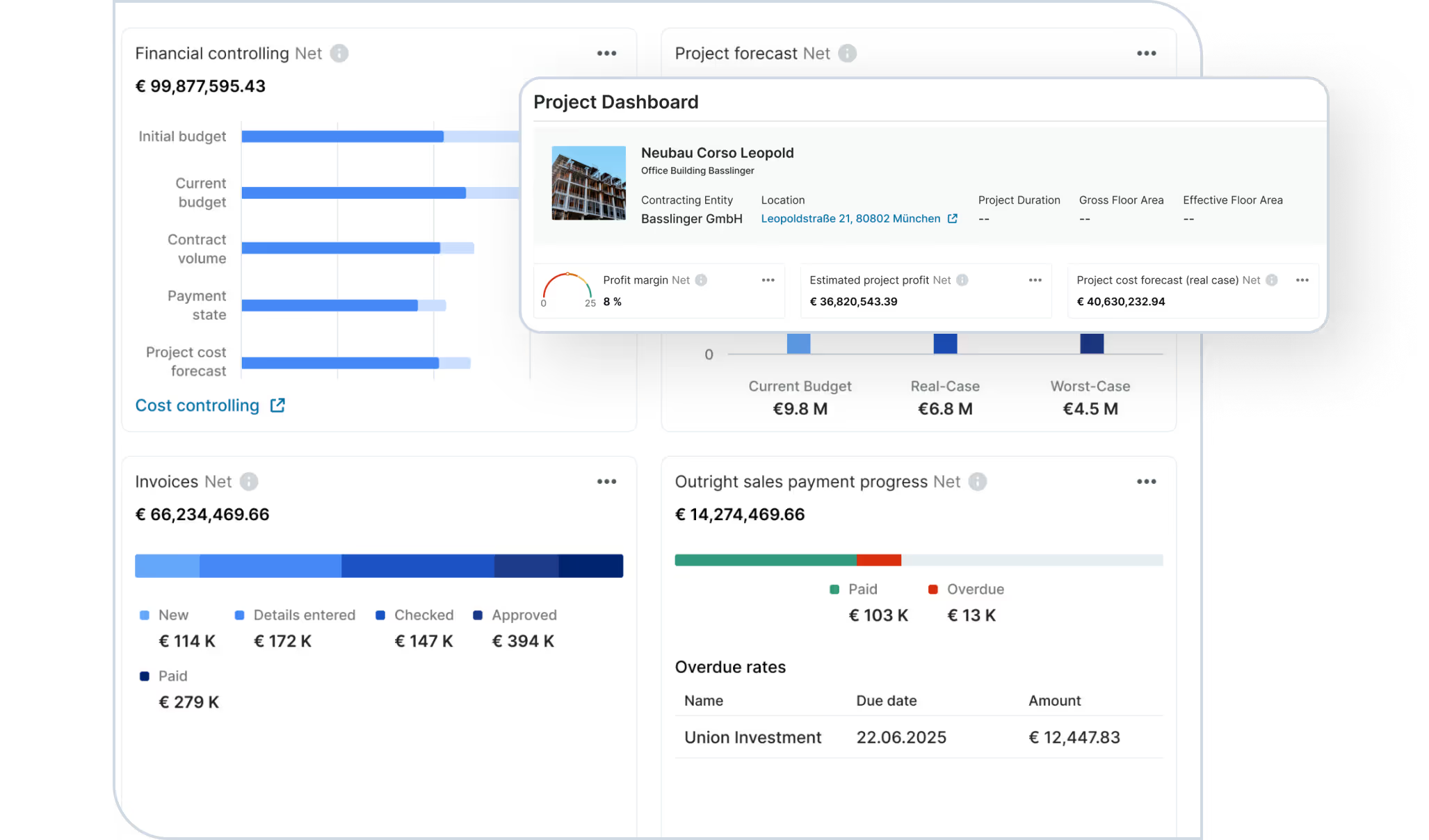

Alasco centralizes all project financials in one cloud-based platform. Role-based access. Unlimited users. Everyone works from the same real-time data with a full audit trail.

No more reconciling Excel files, ERP exports, and email chains.

No more versioning chaos. Just clean data that creates the foundation for AI models that actually work.

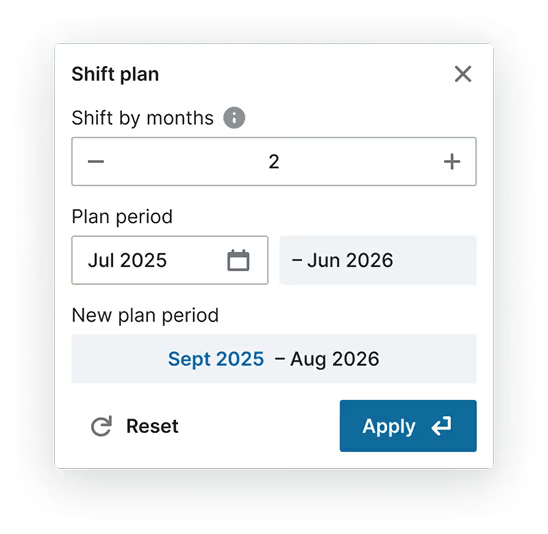

Alasco enables you to create rolling forecasts tied directly to project stages, vendor contracts, and financing tranches. To test scenarios. To adjust plans instantly.

And finally, to see the liquidity impact of every decision.

Financing drawdowns and budget reallocations happen with confidence, not guesswork.

Alasco digitizes the entire approval workflow. Invoices and change orders route automatically based on thresholds, roles, or contract type.

Every action is logged.

What took weeks of chasing signatures now takes days. Faster payments. Happier partners.

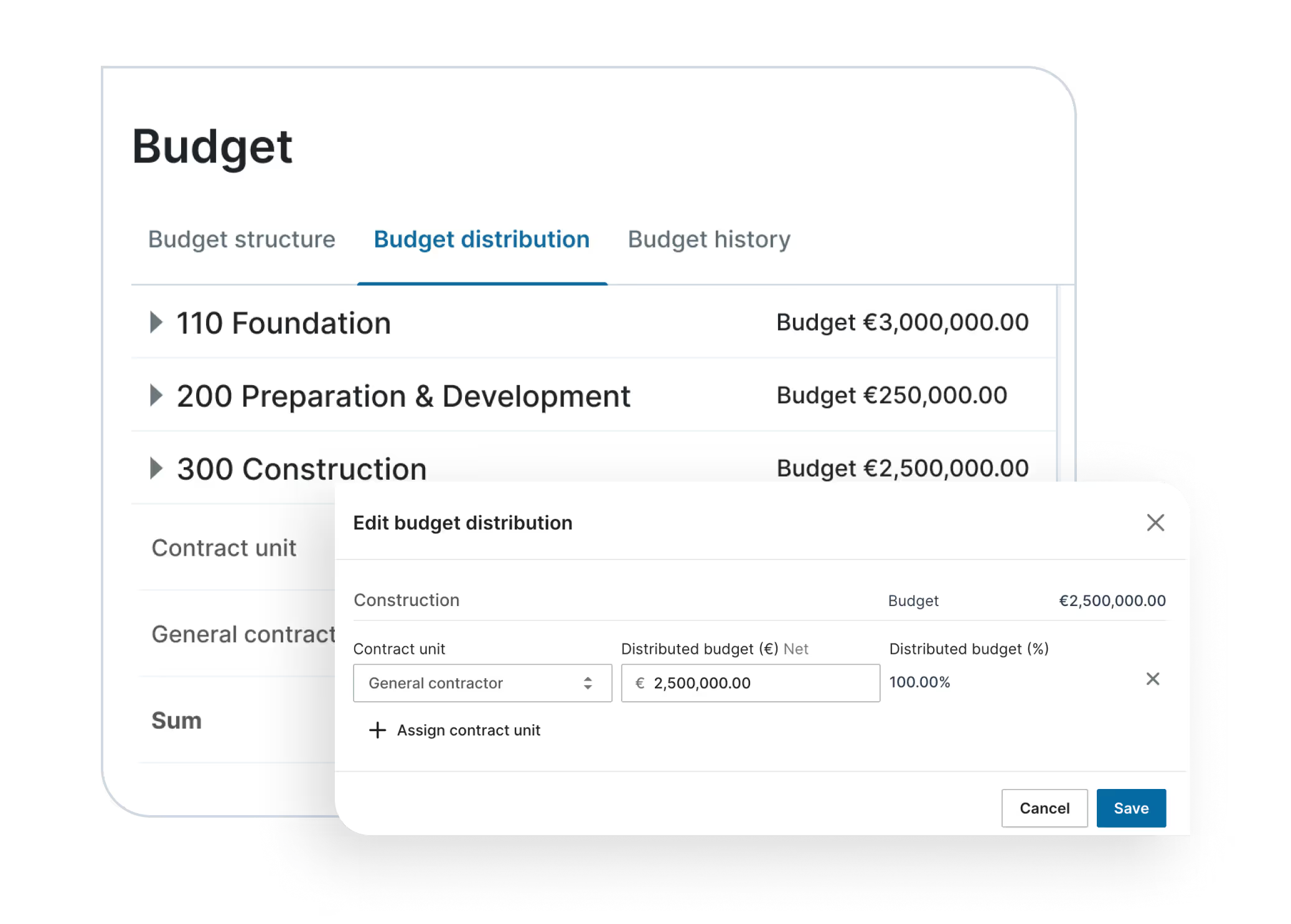

Alasco makes it easy to create consistent cost codes and reporting frameworks across all projects.

Clean budget vs. actual comparisons. Portfolio-wide transparency. Audit-ready reports that investors and lenders trust.

Standardisation makes scaling simple and reliable.

Alasco's AI assistant monitors project data continuously. Detects anomalies. Explains variances by linking them to project budgeting, contracting, or invoicing events. Raises alerts before budget overruns happen.

This way, reporting shifts from backward-looking to an early decision-making system.

case studies

Trusted by Leading Developers For Financial Risk Management

RESOURCES

Discover More Approaches to Strengthen Your Financial Management

FAQ

Frequently Asked Questions

Alasco replaces fragmented Excel sheets with one central system where budgets, invoices, and approvals all live. Every change is logged automatically, eliminating version control problems and reducing errors caused by manual re-entry. Thus, financial oversight is secured.

Instantly. Dashboards update in real time as invoices and approvals flow in. Invoice processing is automated, no matter the format you receive them - PDF, e-invoicing, or scan. You can drill down by project, unit, or portfolio level within seconds.

Alasco provides rolling cash flow forecasts and planned vs. actual comparisons that are customised for your investor or bank, showing just the cost elements and the invoices assigned to that particular funding source. This means you can deliver drawdown reports instantly instead of spending days consolidating Excel files.

Yes. The system is designed for capital-intensive projects, including financing tranches, debt/equity management, and revenue from sales or leases.

Yes. Reports are fully customisable, shareable, and audit-ready. You can add formulas like cost/m², run version comparisons, and export within seconds.

Absolutely. Every budget version is saved with full history. You can compare baseline budgets with rolling cash flow forecasts and drill into what changed, when, and why.

Ready to Choose Control Over Chaos in Managing Your Project Financials?

Join Europe’s top developers already cutting cost overruns and delivering projects on time and on budget with Alasco — and free up 10+ hours per week for your team.

.png)

%20-%20Hero%20Image.avif)