What sustainability decision makers use to deliver and report on their ESG strategy

Create ESG analysis for your real estate properties, devise renovation measures and check subsidies. If you need to report to auditors, banks and investors, we’ve got you covered.

Alasco is for you if…

You need to perform multiple CRREM analysis in a short period of time

Outsourcing these analyses can take months and leads to high costs.

You need real-time, accurate reporting on key sustainability metrics

But this takes a lot of time each year, because you have no single source of truth over energy consumption, water consumption or greenhouse gas emissions.

It’s difficult to identify sustainability opportunities that bring the best ROI

And figure out which properties need to be optimised.

It’s very time consuming to stay on top of sustainability related budgets

Including cost analysis and forecasting, to ensure initiatives are financially viable.

BENEFITS

What you can do with Alasco

Fast ESG reporting to your investors, banks and auditors

Eliminate spreadsheets and manual work to collect data for your ESG compliance reporting. With Alasco, data collection, analysis on CRREM, or Scope 3 emissions become easy, enabling you to report to your auditors or investors on time.

So that you can focus on managing your ESG strategy rather than on building reports.

Features at a glance:

- CRREM path analysis

- EU Taxonomy

- GRESB reporting

- SFRD

- CSRD

- Automated and customised asset and portfolio reporting

Single source of truth for all real estate sustainability projects

Forget hunting down asset consumption data from multiple tenants and still never achieve a complete picture.

With Alasco’s real or estimated consumption figures, you can build a single source of truth, available in real-time to all your stakeholders, including Property Managers and Facility Managers.

Features at a glance:

- Bulk CVS uploads

- APIs for automatic data collection from smart metres

Fast ESG analysis

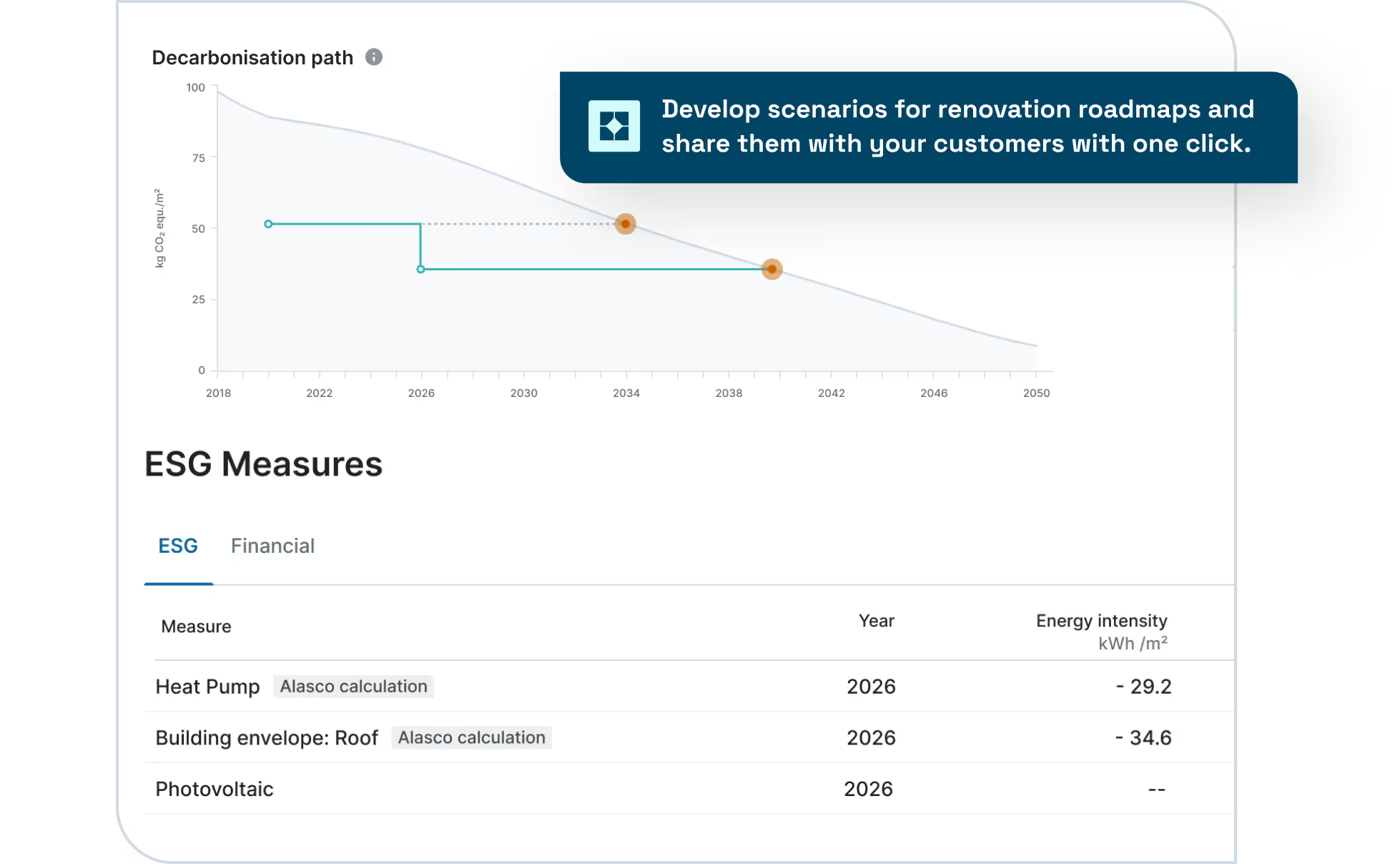

Eliminate emails, phone calls and trips to the property - all to get to an ESG assessment. Now, life feels easier with Alasco’s user-friendly way to develop CRREM analysis and other building KPIs based on actual or estimated data points.

Features at a glance:

- Energy and CO₂ intensities

- Stranding point assessment

- Energy Efficiency Class assessment

- CO₂ tax assessment

Get your sustainability budget approved faster

Hundreds of properties that need your attention, yet developing ESG budgets for each comes with a huge workload or huge expenses.

By using Alasco’s ESG Optimiser capability, you get fast recommendations for retrofits, with cost-benefit analysis on every single measure including: photovoltaic panels, heating system changes, building insulation and more!

Features at a glance:

- Assumption-based calculation of measures

- Simulation on ESG metrics improvement such as CO2 and energy performance

- Financial KPIs and payback period on measure level

- Subsidies available for each measure

- Cost-benefit analysis

TESTIMONIALS

Hear it from our customers

Sustainability and ESG managers from leading asset management companies use Alasco to deliver and report on their ESG strategy with ease.

"The software makes our ESG analysis of properties much easier and enables a high quality standard thanks to a valid database. The integration of benchmarks means that assets with an incomplete database can also be analysed.”

Help the entire team do their best work

Get started with Alasco today

Join the largest real estate asset managers and project developers already increasing the value of their assets with Alasco.

.png)